Terms of Engagement

General

These Standard Terms of Engagement (Terms) apply to any current engagement and to any future engagement, whether or not we send you another copy of them. We are entitled to change these Terms from time to time, in which case we will send you amended Terms. Our relationship with you is governed by New Zealand law and New Zealand courts have exclusive jurisdiction.

Services

The services we are to provide for you (Services) are outlined in our letter of engagement along with any further instructions that you provide to us in writing (or that we record in writing).

To provide you with efficient advice and services and to provide the most cost-effective service, it may be that part, or all your instructions will be delegated to other professionals in our firm.

We do not provide any advice as to the profitability, prudence, or desirability of completing a transaction, nor as to the tax effects or implications of it. This advice should be obtained by you from your accountant or other tax specialist.

Conflicts Of Interest

Before we agree to complete any work for any person, we undertake a check of our records to determine whether that work will create a conflict of interest for us.

If a conflict of interest arises, we will advise you of this and follow the requirements and procedures set out in the Rules. This may mean we cannot act for you further in a particular matter and we may terminate our engagement.

If you believe a conflict of interest has arisen, please tell us immediately.

Communications

We will obtain from you your contact details, including email address, postal address, and telephone numbers. You will advise us if any of your contact details change.

We will normally communicate with you electronically. Electronic communications are not secure. They may be read, copied, or interfered with in transit. We will take reasonable care in communicating with you electronically. However, we are not responsible for any of the risks associated with electronic communications.

We will report to you periodically on the progress of any engagement and will inform you of any material and unexpected delays, significant changes or complications in the work being undertaken. You may request a progress report at any time.

You agree that we may provide you from time to time with other information that may be relevant to you, such as newsletters and information. At any time, you may request that this not be sent to you.

Fees

The basis upon which we will charge our fees is set out in our engagement letter.

If the engagement letter specifies a fixed fee, we will charge this for the agreed scope of the Services. Work which falls outside that scope will be charged on an hourly rate basis. We will advise you as soon as reasonably practicable if it becomes necessary for us to provide services outside of the agreed scope and, if requested, give you an estimate of the likely amount of the further costs.

Where our fees are calculated on an hourly basis, the hourly rates of the people we expect to undertake the work are set out in our engagement letter. Any differences in those rates reflect the different levels of experience and specialisation of our professional staff. Time spent is recorded in six-minute units.

Hourly fees may be adjusted (upwards or downwards) to ensure the fee is fair and reasonable to consider matters such as the complexity, urgency, value, and importance of the Services. Full details of the relevant fee factors are set out in Rule 9 of the Lawyers and Conveyancers Act (Lawyers: Conduct and Client Care) Rules 2008 (Rules).

If we are providing conveyancing services for you, you must pay us for all our time and disbursements on the day of settlement. We will give you a total figure to settle your account with us on that day at the latest.

Fees and Disbursements In Advance

We may ask you to pre-pay amounts to us, or to provide security for our fees and expenses. We may do this, on reasonable notice, at any time.

Estimates

You may request an estimate of our fee for undertaking the Services at any time. If possible, we will provide you with an estimate (which may be a range between a minimum and a maximum amount or for a particular task or step). An estimate is not a quote. Any significant assumptions included in the estimate will be stated and you must tell us if those assumptions are wrong or change. We will inform you if we are likely to exceed the estimate by any substantial amount. Unless specified, an estimate excludes GST, disbursements and expenses.

Disbursements and Third-Party Expenses

In providing the Services we may incur disbursements and payments to third parties on your behalf. You authorise us to incur these disbursements (which may include such items such as search fees, LIM fees, registration fees and courier charges) which are reasonably necessary to provide the Services. You also authorise us to make payments to third parties on your behalf which are reasonably required to undertake the Services (which may include items such as experts’ costs or counsel’s fees). These will be included in our invoice to you, shown as “disbursements” when the expenses are incurred (or in advance when we know we will be incurring them on your behalf).

Office Service Charge Fee (Administrative Fee)

In addition to disbursements, we may charge a fee to cover out of pocket costs which are not included in our fee, and which are not recorded as disbursements.

We do not recover individual internal copying, binding, printing, tolls, or faxes under $20 (for example, 100 pages of plain paper b/w printing) as separate costs. Instead, we charge an administrative fee on a stepped basis as follows:

| Fee | Administrative Fee |

| <$1,000.00 | $25 |

| $1,001.00 - $2,000.00 | $50 |

| $2,001.00 - $3,000.00 | $65 |

| >$3,001.00 | 2.5% of fee |

GST

Our services will usually attract Goods and Services Tax (GST). If this is the case, GST is payable by you on our fees and charges.

Invoices

We will send interim invoices to you, usually monthly, and on completion of the matter, or termination of our engagement. We may send you invoices more frequently when we incur a significant expense or undertake a significant amount of work over a shorter period.

Payment

Invoices are payable on settlement of property transactions, and in other cases within 14 days of the date of the invoice, unless alternative arrangements have been made with us.

You authorise us to deduct our fees and other expenses from funds held in our trust account on your behalf on provision of an invoice to you unless those funds are held for a particular purpose.

If you have difficulty in paying any of our accounts, please contact us promptly so that we may discuss payment arrangements.

If your account is overdue, we may:

a. require interest to be paid on any amount which is more than 14 days overdue, calculated at the rate of 2% above the overdraft rate that our firm's main trading bank charges us for the period that the invoice is outstanding.

b. stop work on any matters in respect of which we are providing services to you.

c. require an additional payment of fees in advance or other security before recommencing work.

d. recover from you in full any costs we incur (including on a solicitor/client basis) in seeking to recover the amounts from you, including our own fees and the fees of any collection agency.

Payment may be made by bank deposit to Summit Law Limited.

Third Parties

Although you may expect to be reimbursed by a third party for our fees and expenses, and although our invoices may at your request or with your approval be directed to a third party, you remain responsible for payment to us in accordance with these Terms if the third party fails to pay us.

Trust Accounting

We maintain a trust account with ASB Bank for all funds which we receive from clients (including monies received for payment of our invoices).

We are obliged under Section 114 of the Lawyers and Conveyancers Act, 2006 where practicable to place client monies, held on behalf, on interest-bearing deposit. With the additional FATCA\CRS compliance obligations our terms of engagement now provide that our clients agree that money will not be placed on deposit as a matter of course. If monies are placed on deposit by us through our bank that can only be done so once the appropriate bank self-certification forms have been properly completed, signed, and returned to us. Clients also irrevocably consent as part of their engagement with us, to the disclosure of their information relating to those funds that are or will be held on IBD to the IRD and bank maintaining those funds.

If monies are placed on deposit, you agree that we will charge an administration fee of 7.5% on the gross interest. We are not responsible for obtaining the best interest rate available when placing your funds on IBD or for any loss of interest you may suffer because of any delay in placing your funds on deposit. You also agree we will have no liability arising from the loss of any amounts deposited by us on your behalf in accordance with these payments procedures and conditions where the loss results from the act, neglect, or default of a financial institution.

If we hold any funds in credit that remain for a period of 3 months or more after a matter is completed and belongs to you, we will generally make reasonable efforts to locate you to arrange for the amount to be paid to you.

We may deduct our reasonable costs of trying to locate you to pay those monies in credit. If the amount is small (under $10), it is not economic for us to try to locate you and we are not holding current contact details for you, we may not attempt to locate you. For any other amounts, funds will be refunded to you, or, where your contact details or bank account details are not available, credited to the Inland Revenue Department’s unclaimed monies account within a period of 6 months after the completion of a matter.

Duty of Care

The scope of our retainer is to provide the Services. We do not owe you any duty of care in relation to matters that go beyond the scope of our retainer.

Our duty of care is to you and not to any other person. We owe no liability to any other person who may be affected by our performance of the Services or who may rely on any advice we give, including, for example, any directors, shareholders, associated companies, employees, or family members, unless we expressly agree in writing.

Our advice is not to be referred to in connection with any prospectus, financial statement, or public document without our written consent.

Our advice is opinion only, based on the facts known to us and on our professional judgement, and is subject to any changes in the law after the date on which the advice is given. We are not liable for errors in, or omissions from, any information provided by third parties.

Our advice relates only to each matter in respect of which you engage us. Once that matter is at an end, we will not owe you any duty or liability in respect of any related or other matters unless you specifically engage us in respect of those related or other matters.

Confidentiality

We will hold in confidence all information concerning you or your affairs that we acquire while acting for you. We will not disclose any of this information to any other person except:

• to the extent necessary or desirable to enable us to carry out your instructions; or

• as agreed by you expressly or impliedly; or

• as necessary to protect our interests in respect of any complaint or dispute; or

• to the extent required or permitted by law.

Personal Information and Privacy

We will collect and hold personal information about you. We will use that information to carry out the Services and to contact you about issues we believe may be of interest to you. Provision of personal information is voluntary but if you do not provide full information this may impact on our ability to provide the Services.

Subject to the paragraph above, you authorise us to disclose your personal information to third parties for the purpose of providing the Services and any other purposes set out in these Terms.

The information we collect and hold about you will be kept in a secure electronic file storage site. If you are an individual, you have the right to access and correct this information. If you require access, please contact us.

Documents, Records and Information

We will keep a record of documents which we receive or create on your behalf on the following basis:

• We may keep a record electronically.

• At any time, we may dispose of documents which are duplicates, or which are trivial (such as emails which do not contain substantive information), or documents which belong to us.

Unless you instruct us in writing otherwise, you authorise us and consent to us (without further reference to you) to destroy (or delete in the case of electronic records) all files and documents in respect of the Services seven years after our engagement ends (other than any documents that we are obliged by law to retain for longer). We may retain documents for longer at our option.

AML/CFT Act Obligations

We are required to comply with all laws binding on us including (but not limited to):

• the Anti-Money Laundering and Countering Financing of Terrorism Act 2009 (AML/CFT Act); and

• the United States Foreign Account Tax Compliance Act (FATCA); and

• the Common Reporting Standard (CRS).

To meet these requirements, we may be required to conduct customer due diligence on you, persons acting on your behalf, and other relevant persons such as your beneficial owners or persons who have effective control of you as a client. We may not be able to act or continue acting for you until this is completed to the required standard.

We will advise you what information and documents are required for these purposes. This information could include formal identification, address confirmation, source of funds, transaction details, ownership structures, tax identification details, and any other information considered relevant. Please ensure the information and documents requested are provided promptly to avoid any delays in us acting for you.

We will retain the information and documents and may be required to disclose them to government agencies as required by law. We may not be permitted to advise you of the instances when we are required to disclose this information. We may also be required to provide this information to banks with which we place your funds through our trust account.

We may conduct and you agree to our electronic identity verification (through a third-party provider) of you and those other people associated with you, in line with the Amended Identity Verification Code of Practice 2013 (IVCOP). Identification involves us obtaining information from the client about their identity. Verification involves confirming this information using documents, data, or information from reliable and independent sources.

Indemnity Insurance

We hold professional indemnity insurance that meets or exceeds the minimum standards specified by the Law Society. We will provide you with particulars of the minimum standards upon request.

The Law Society maintains the Lawyers' Fidelity Fund for the purpose of providing clients of lawyers with protection against loss arising from theft by lawyers. The Lawyers’ Fidelity Fund does not provide any cover in relation to a barrister sole and therefore does not provide protection against loss relating to my services.

Limitations On Our Obligations Or Liability

To the extent allowed by law, our aggregate liability to you (whether in contract, tort, equity or otherwise) is limited to the amount payable under our professional indemnity insurance policy.

Applicable Law

Our relationship is governed by New Zealand law and New Zealand courts have exclusive jurisdiction.

Termination

You may terminate our retainer at any time.

We may terminate our retainer in any of the circumstances set out in the Rules including the existence of a conflict of interest, non-payment of fees, and failure to provide instructions.

If our retainer is terminated you must pay us all fees, disbursements and expenses incurred up to the date of termination.

Feedback And Complaints

Client satisfaction is important to us. Please contact us with any comments you would like to make on any aspect of our service, including how we can improve our service.

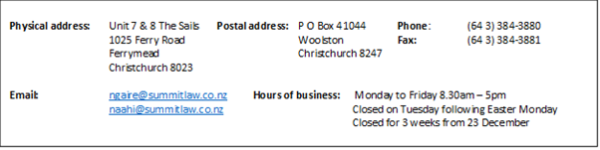

If you have any concerns or complaints about our services, please raise them as soon as possible with us. We will endeavour in good faith to resolve the matter with you in a way that is fair to all concerned. Feedback or concerns may be directed to:

If you are still not satisfied, the Law Society has a complaints service. You can call the 0800 number for guidance, lodge a concern or make a formal complaint. Matters may be directed to:

Lawyers Complaints Service, PO Box 5041, Wellington 6140, New Zealand

phone: 0800 261 801

email: complaints@lawsociety.org.nz;

website: www.lawsociety.org.nz/for-the-community/lawyers-complaints-service

The Law Society’s client care and service information

Whatever legal services your lawyer is providing, he or she must:

• act competently, in a timely way, and in accordance with instructions received and arrangements made;

• protect and promote your interests and act for you free from compromising influences or loyalties;

• discuss with you your objectives and how they should best be achieved;

• provide you with information about the work to be done, who will do it, and the way in which the services will be provided;

• charge you a fee that is fair and reasonable, and let you know how and when you will be billed;

• give you clear information and advice;

• protect your privacy and ensure appropriate confidentiality;

• treat you fairly, respectfully, and without discrimination;

• keep you informed about the work being done and advise you when it is completed; and

• let you know how to make a complaint, and deal with any complaint promptly and fairly.

The obligations lawyers owe to clients are described in the Rules of Conduct and Client Care for Lawyers. Those obligations are subject to other overriding duties, including duties to the courts and to the justice system.

If you have any questions, please visit www.lawsociety.org.nz or call 0800 261 801.